property tax assessor las vegas nv

If you do not receive a postcard by July 15 please call us at 702 455-4997. Clark County Detention Center Inmate Accounts.

Be Sure To Lower Your Property Tax By Filing A Primary Residential Tax Cap Claim Ksnv

Overall there are three stages to real property taxation.

. FOX5 - Homeowners were sent a postcard saying rates would jump to 8 if primary residence was not declared by. Las Vegas NV 89155 315 S. Land and land improvements are.

Assessor - Personal Property Taxes. LAS VEGAS NV 89118. The Taxpayer Advocate Service is an independent organization within the IRS that helps protect your taxpayer rights.

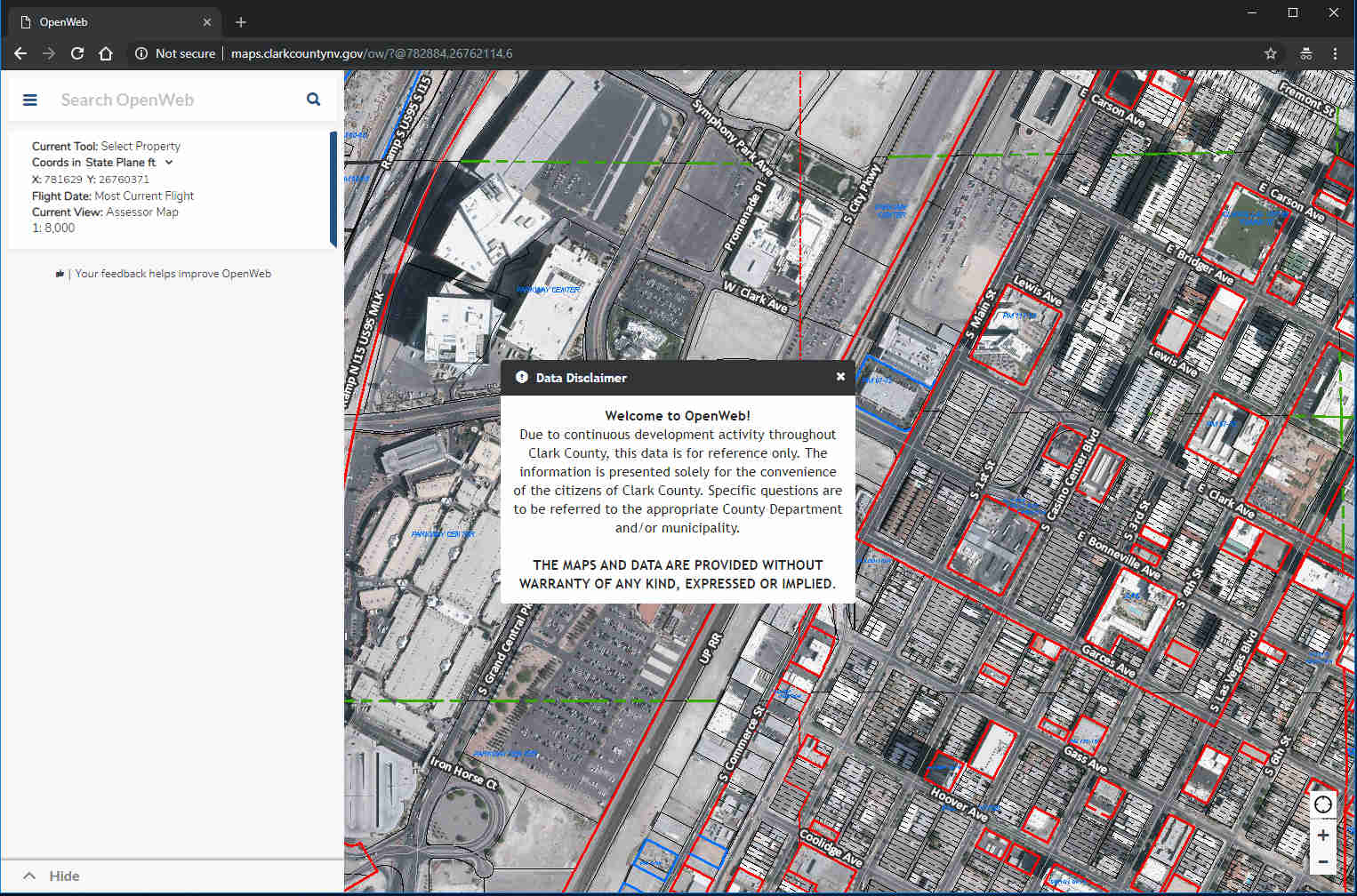

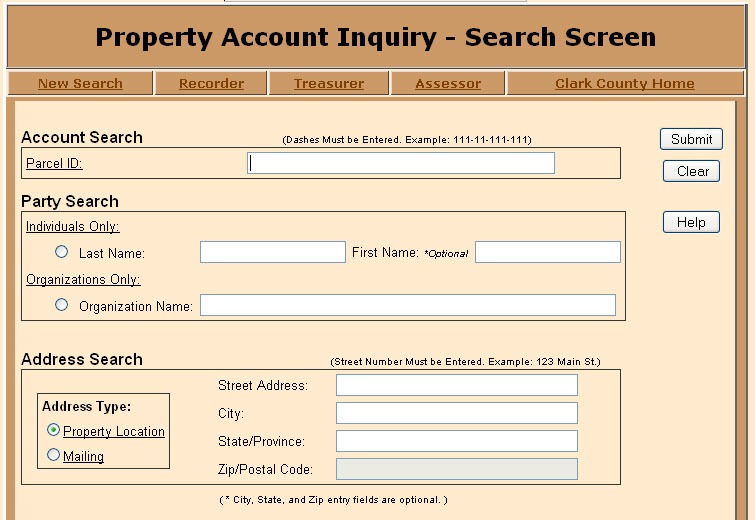

Public Property Records provide information on land homes and commercial. Parcel inquiry - search by Owners Name. Check here for phonetic name match.

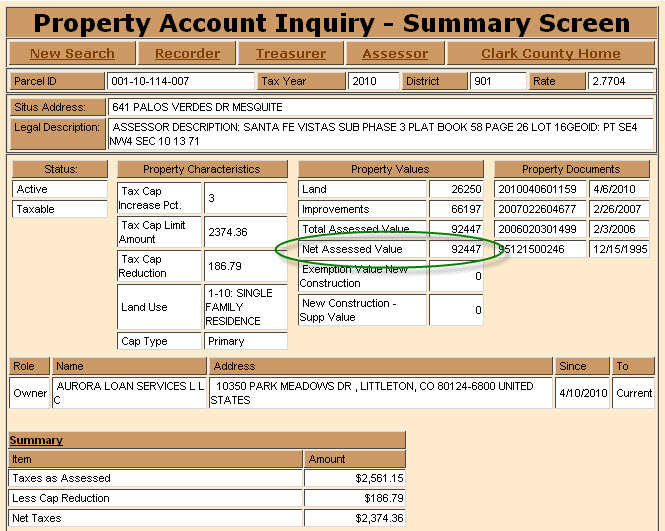

Nevada county assessor offices grant tax relief to DMV customers. Humboldt Street 398 Main. In Nevada the property-tax increase for someones primary residence is a maximum of 3 percent and the increase for other kinds of properties including land and.

Or Company Name Last Name Required. Grand Central Parkway 2nd Floor Las Vegas Nevada 89155. Real Property Assessed Value Fiscal Year 2021-22.

Establishing tax levies evaluating property worth and then collecting. Clark County Assessors Office Suggest Edit. Las Vegas NV 89106.

730am - 530pm Tue. Property Tax Rates for Nevada Local Governments Redbook NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues. About Assessor and Property Tax Records in Nevada Nevada real and personal property tax records are managed by the County Assessor in each county.

In the Parcel ID field enter a parcel number 8 digits no dashes. 29 2022 at 526 PM PDT. A Las Vegas Property Records Search locates real estate documents related to property in Las Vegas Nevada.

6580 FOLEY ESTATE AVE. Exemptions may be used to reduce vehicle Governmental. Provide information to taxpayers and.

The Treasurers office mails out real property tax bills ONLY ONE TIME each fiscal year. AOCustomerServiceRequestsClarkCountyNVgov 500 S Grand Central Pkwy Las Vegas Nevada 89155. 500 South Grand Central Parkway.

110 N City Pkwy. Assessor - Personal Property Taxes. Certain rural assessors also offer vehicle registration services.

Las Vegas Nevada 89155. Every municipality then receives the assessed amount it levied. Bill and collect taxes on the unsecured roll.

Click on Assessor Property Inquiry. Our main office is located at 500 S.

Nevada Property Tax Bills Very Vintage Vegas Las Vegas Mid Century Modern Homes

Fillable Online Clarkcountynv On Line Fillable Forms Clark County Nevada Fax Email Print Pdffiller

Assessor S Office Clark County

Are You Paying The Right Amount For Property Taxes

Taxpayer Information Henderson Nv

Las Vegas Housing Market Prices Trends Forecast 2022 2023

Nevada Homeowners May Be Paying More On Property Taxes

North Las Vegas Nv Land For Sale Acerage Cheap Land Lots For Sale Redfin

Mesquitegroup Com Nevada Property Tax

Las Vegas Area Clark County Nevada Property Tax Information

Calculating Las Vegas Property Taxes Las Vegas Real Estate Las Vegas Homes For Sale Las Vegas Real Estate

Property Tax Cap Property Owners In Clarkcounty May Still File A Claim For A Primary Residential Tax Cap Rate Of 3 Percent On Their Taxes For The 2019 2020 Fiscal Year

Be Sure To Lower Your Property Tax By Filing A Primary Residential Tax Cap Claim Ksnv

Bills Mailed By Clark County Do Not Reflect Corrections Of Property Tax Caps

Differences Between A County Assessor Recorder Reed Mansfield